How you allocate your money among stocks, bonds, and short-term reserves may be the most important factor in determining the long-term return and volatility of your portfolio. Once you have determined your asset allocation, rebalancing your portfolio once a year is a good practice. You can pick a date (such as your birthday or anniversary) to rebalance your portfolio.

If you have one or more accounts at Vanguard, they offer two great tools for investors - Portfolio Watch and Portfolio Tester. Portfolio Watch helps you analyze your portfolio and Portfolio Tester enables you to test portfolio changes before submitting actual orders. These tools can help you to determine and set your target allocation, monitor any deviations from the target and help you with required rebalancing, if necessary.

You will find the Portfolio Watch tool as the last tab on the Overview page.

Portfolio Watch provides powerful analysis that helps you understand your assets, how your asset mix impacts your potential for growth and your portfolio risk, and how your costs compare with the industry averages. The Portfolio Watch home page provides a high-level analysis of your assets while each section allows you to see a more detailed analysis.

Portfolio Tester enables you to do “what-if” analysis of your planned changes before submitting actual buy, sell or exchange orders. This tool is handy when you want to rebalance your portfolio or when you are planning to add new money to your account or to sell part of your investments for withdrawal. You can use the Portfolio Tester tool to enter hypothetical orders (buy and/or sell) and view their effect on your asset allocation.

Although the portfolio watch tool is powerful and useful, some of the alerts generated by the tool should be taken with a grain of salt. Take the following portfolio alert, for example:

I think 30% to 50% allocation to foreign stocks is too high. I personally use 20% of the equity portion of the portfolio as my target allocation for international stocks. You may be using a different rule based on your needs and preferences. So, while the analysis is useful, use your own judgment and experience when reviewing the information, charts and especially the alerts presented by the tool. I primarily use this tool to view and monitor asset allocation. Related Post: Rethinking Global Exposure: How Much "International" Is Already in Your U.S. Stocks?

By default, Portfolio Watch includes all assets available for analysis. You can create custom groups to analyze specific assets or accounts.

The tool works best if you have all your investment accounts at Vanguard. However, outside assets are included if you have linked non-Vanguard accounts to your Vanguard account. You can also manually add outside assets for analysis. Manually added funds and stocks with ticker symbols are classified automatically by the tool. Some of the manually added assets for which data is not available may appear as an "Other" asset type. However, you can manually classify them as a "Stock", "Bond", or "Short-term reserve".

You can click the Portfolio Tester link on the top of Portfolio Watch page to initiate the tool.

On the Portfolio Tester tool, you have an option to enter one or more new holding(s) you are planning to buy or make changes to your existing holdings. Use a "-" sign for sales. For example, if you are planning to exchange a fund or ETF worth $10,000 to another fund or ETF, enter -10000 as the amount on an existing line for the fund or ETF you are planning to sell, under the appropriate account in which the fund is held and enter 10000 (without a sign) on the line for the fund or ETF you are planning to buy. For new purchases, simply enter an amount without a sign either on an existing line (if you already hold the fund) or add a new line.

The following screenshots illustrate the scenario where the investor plans to move $10,000 from the Total Stock Market Index Fund to the Total International Stock Index Fund. Note the "-" sign in "-10000" for the first fund.

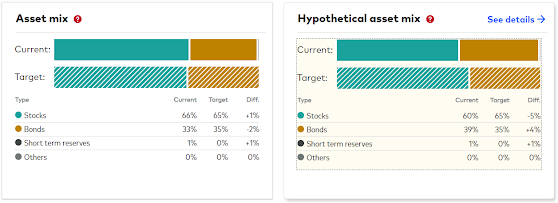

Clicking the Analyze button presents the comparative analysis of your current and hypothetical portfolio (after planned changes) with an option to drill into each section for details.

Click "See Details" next to Hypothetical Asset Mix to see the detailed analysis including risk and return for both portfolios, using past 97 years' data (1926-2022).

Note that selling an appreciated fund may trigger a tax bill unless you are careful. Start with tax-sheltered accounts - 401(k) and IRA - when rebalancing. See the following article for more tax-efficient rebalancing strategies: 7 Rebalancing Strategies That Are Tax-Efficient, Too!

Related:

Using Vanguard Investor Questionnaire to determine your asset allocation

Improve Long-term After-tax Return on 3-fund Portfolio using Asset Location

The Stock Market has (fill in the blank). What should I do now?

Disclaimer: This article is not intended to be investment advice. Consult a duly licensed professional for investment advice. The contents of this article are for educational purposes only and do not constitute financial, accounting, tax, or legal advice. Past performance is no guarantee of future results.